If the thought of lodging your tax return makes your palms sweaty and you find yourself procrastinating to avoid the inevitable, you’re not alone. Xero’s latest research has found nearly three quarters of Australians are worried or anxious about tax time this year.¹

This end of financial year (EOFY), we wanted to uncover the universal challenges that Aussies face and common knowledge gaps when it comes to tax time, and provide easy-to-understand information to reduce confusion and anxiety at this time of year.

The ‘Xero Tax Confidence Index’ surveyed more than 1000 Australians – including small business owners – to gauge their confidence and knowledge levels around all things tax. We found 73% of Australians report feeling worried or stressed at EOFY, with most small business owners echoing this sentiment. More than half (54%) of Australians are worried about making an error on their tax return: key concerns included owing money to the Australian Taxation Office (33%), following tax rules correctly (28%), and being audited by the ATO (22%).

For Australia’s 2.6 million small business owners, tax season often adds pressure on top of managing day-to-day operations. In fact, Xero research from 2024 revealed 83% of small business leaders find EOFY overwhelming and 71% find it stressful.²

There are no silly questions

One in five Australians say they have avoided asking tax-related questions because they were worried their question might seem silly or the answer obvious, and our small business research also shows one in three business leaders find tax preparation overwhelming.² But when it comes to tax and finances, there’s no such thing as a silly question! We want people to feel more comfortable, know they are not alone, and feel encouraged to reach out for help.

Tax deductions are a key area of confusion. While 58% of Australians made purchases last year with the intention of claiming them as tax deductions, 51% admitted to being confused about deduction rules. The biggest areas of confusion were car and travel expenses (21%) and working from home costs (21%). Half of those who made a purchase specifically for a tax deduction last year found it didn’t turn out how they wanted, with 21% discovering their purchase was ineligible to claim a deduction for, and 17% not getting the return they wanted.

Putting tax knowledge to the test

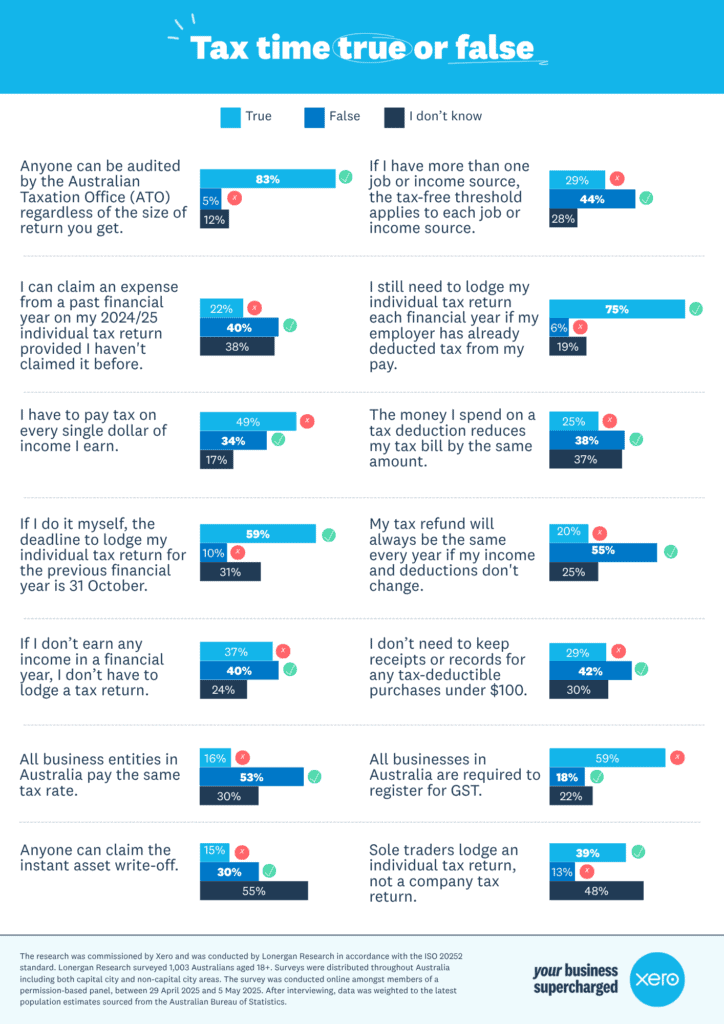

To further dig into Australians’ tax knowledge, we presented participants with true or false statements on common tax scenarios.

Finding the right support

Encouragingly, most Australians turn to trusted sources for tax guidance: the official ATO website (51%) and tax agents or accountants (40%) are the leading go-tos. Having the right support in place is critical for both taxpayers and small businesses alike. Not only does it provide confidence that they’re doing the right thing, it alleviates the stress and anxiety that can come with this time of year. Engaging a trusted advisor is invaluable; they’re the experts who can answer any question, no matter how silly it might seem, and guide you through the process. We know from our strong accounting partner community that they’d be happy to help, so the next time you have a question, don’t hesitate, ask your advisor.

Digital tools can also help ease the burden by automating some of the more complex or time-consuming tasks and keeping you organised, whether that’s simply capturing your expenses for claiming deductions, or more complex tasks for small businesses like managing records, financial statements and tax compliance.

For small businesses looking for information and support this tax time, in addition to speaking with your advisor, you can visit Xero’s EOFY resource hub for tools and resources to help you blast past tax-time stress.

About the research

¹ Xero’s Tax Confidence Index research was commissioned by Xero and conducted by Lonergan Research. Lonergan Research surveyed a nationally representative population of 1003 Australians aged 18+. After interviewing, data was weighted to the latest population estimates sourced from the Australian Bureau of Statistics. The survey was conducted online amongst members of an independent and permission-based panel, between 29 April 2025 and 5 May 2025.

² Small business research was commissioned by Xero and conducted by YouGov. The total sample size was 1077 Australian adults, with 80% from NSW, VIC and QLD, who are small business owners and decision makers in businesses with fewer than 20 employees. Fieldwork was undertaken between 10 and 19 May 2024. The survey was carried out online.

The post Half of Australians fear making a mistake on their tax return this year appeared first on Xero Blog.